When I sent out my annual survey at the end of 2021, the most common topic you all asked about was business finances. How do I track revenue and expenses, how do I budget with sometimes unpredictable income streams, what apps or tools do I use to manage all the money things? I'm not huge on sharing exact income numbers, because I think money can be so relative depending on where you live, your life circumstances, etc. Also just like privacy, ya know?! 🙃 But I'm happy to share the tools I use, and where my revenue comes from.

WHERE MY REVENUE COMES FROM

My business has changed a lot over the years, but here's how it broke down in 2021:

68% – Courses & classes

10% – Affiliate income

11% – Client work

8% – Etsy shop printables

3% – Pottery sales

Obviously digital products is my main source of income, and it has been the majority since about 2015 when my first course, The InDesign Field Guide, first launched. This year, I'm wanting to diversify by experimenting more with affiliate marketing, client projects, and pottery sales. Those can take more work than digital product sales, but they're bringing me more joy lately, so the trade-off is worth it to me (at least for now!). I also want to acknowledge that this is not an overnight pie chart. I took my business full-time in 2015, and my focus was all on client work at the time. I launched my first course later that year, and over time it overshadowed the client income.

WHAT ARE MY EXPENSES?

I'm a frugal gal, so I pride myself on keeping my overhead costs as low as I can since my business started. I've gone through seasons of more spending for coaching programs or experimenting with advertising, etc., but I'm back in a season of just wanting to keep all costs way down. Here's the breakdown from last year:

33% – Software subscriptions (Adobe, Squarespace, Convertkit, Vimeo, etc.)

25% – Transaction fees (Paypal, Stripe, and Etsy)

20% – Virtual assistant

9% – Paid advertising (Instagram and Pinterest)

8% – Affiliate payouts

5% – Miscellaneous (office supplies, PO Box, etc.)

I've managed to keep my profit margin in the 80-90% range, which is feasible for a primarily digital-product-based business. This isn't as realistic for a handmade business (looking at you, pottery! 😳) Again, I prefer to run a very lean business with as few paid tools as I can – call me cheap!

WHAT TOOLS DO I USE TO TRACK EVERYTHING?

Spreadsheets

For my business finances, I use a good old fashioned spreadsheet to track my monthly revenue, launches, sales, stats, anything data-related. I created this very basic spreadsheet in Numbers, and just have a bunch of different tabs tracking different things. The main tab I keep open is my monthly income + expenses tab. I have one for each year going aaaaaall they way back to 2007 when I got my very first freelance client. Can you say nostalgic?! Here's an example of what that spreadsheet tab looks like:

At the top I have each product or revenue source listed, and a column for each month where i can project what I think I'll make that month (planning ahead financially for sales, client projects, or slow seasons), and a column next to it to record the actual earned amount each month. I literally keep this sheet updated in real time as I make sales, or at least once a month when I look at my personal finances (I'll talk about that in a minute!).

Below the income section, I have an expenses section broken out in the same way – projection and actual numbers, categorized by individual apps and softwares I use each month. I even include yearly payments here so I can know which month it's coming out and plan ahead for it.

Another tab I use a lot is a Monthly Stats tab where I fill in stats on the last day of every month for numbers like email subscribers, sources where subscribers are coming from (Instagram, Blog Posts, YouTube, etc.), sales by product, website traffic, etc. It's helpful to see and think about these numbers once a month, and especially to see how they change from month to month and even year to year, all at a glance.

Quickbooks

The only other tool I use for my business finances is Quickbooks. I have their lowest plan, and I use it to:

invoice clients (and they can pay online through my link)

record my monthly income and expenses, categorized by all their sources

export yearly profit/loss reports that I use to do my taxes

reconcile my monthly income and expenses with my business bank account and credit card

I'll be honest, Quickbooks overwhelms me. I know how to navigate to the few tools I use in it, and that's it. I knew I needed a more legit bookkeeping system besides my little spreadsheets, so I hired an accountant for a few hours (shoutout to Amy Northard!) to basically setup my Quickbooks account for me and tell me exactly what to do each month. The first year or so, I would mess up something just about every month, and she'd have to go into my account and fix it. But the more I did it, the faster I got at it (I can do all my bookkeeping in about 30 minutes per month now), and the fewer mistakes I made. Again, I'm scrappy and frugal, and I would rather learn how to do the process myself than hire it out. I still refer to my notes from my calls with Amy every single month when I do my bookkeeping.

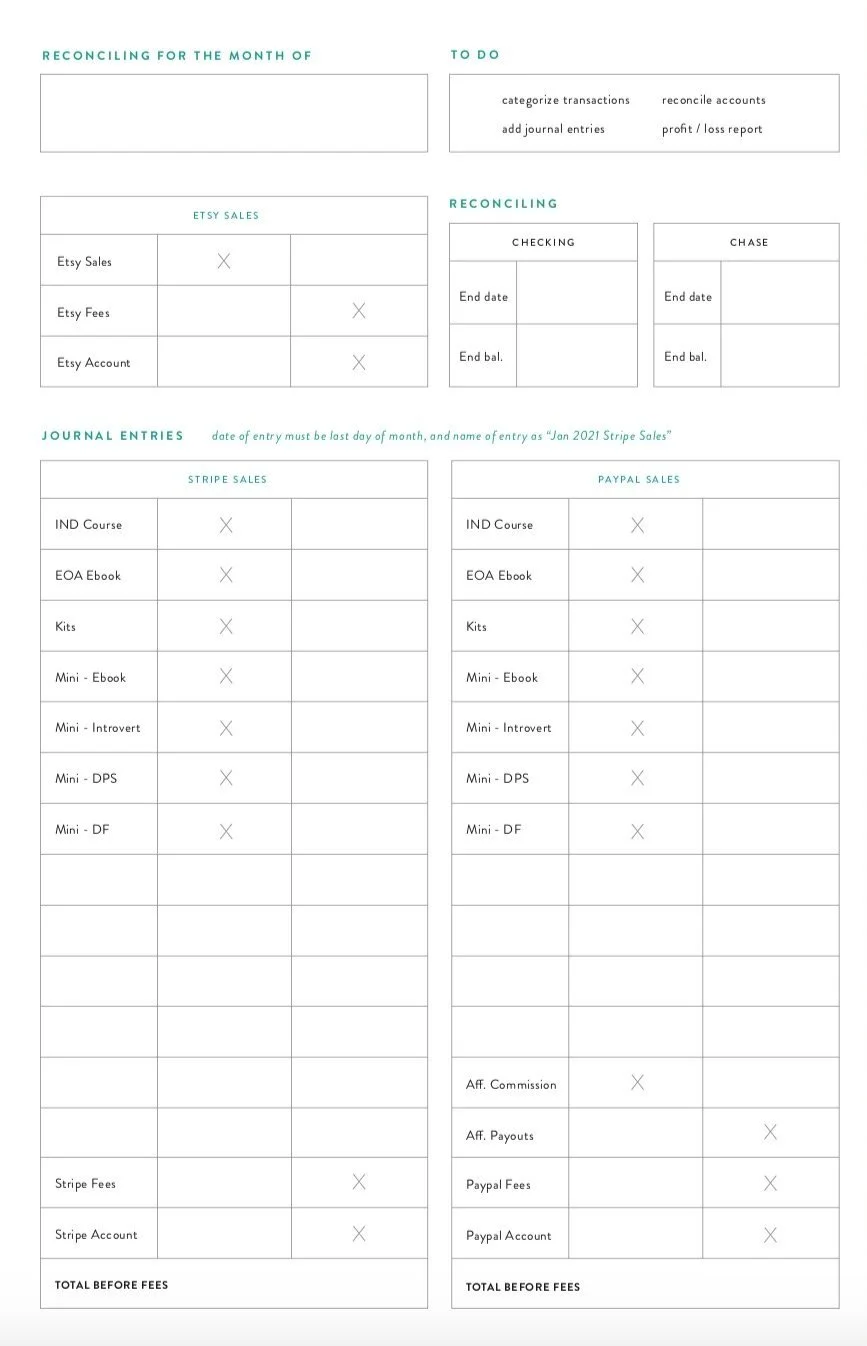

Once a month, I record my income in Quickbooks based one my payment processors (Etsy, Paypal, and Stripe), and my expenses based on my checking account and my credit card transactions. I created a notepad to help me remember what to record each month, and I transfer that info to Quickbooks after I write it down from all the different sources (Etsy, Paypal, Stripe, online banking, etc.). Here's what that notepad form looks like, but again, this is based on my own business's income streams and the systems the accountant helped me setup, so I don't offer this as a download or anything. But feel free to make your own that match your business's needs!

I have a task in Asana that repeats monthly to do my bookkeeping, so it never falls through the cracks.

Mint

Lastly, my personal finances. I've tried quite a few budgeting apps over the years, but I always end up back with Mint. It's free, it's pretty simple and straight-forward, and like all the other apps I've mentioned in this series, I just use the parts I need and don't mess with the rest. I used to keep a personal budgeting spreadsheet as well, to help me project months out (Mint doesn't let you budget further out than the month you're in, which is my only hangup with the app!), but it ended up just being the same data as my business spreadsheets, so I simplified and scrapped it. I have a task in Asana that repeats weekly to look at my budget, categorize transactions in Mint, and pay bills.

While we're on the subject of numbers, I want to shoutout my friend Janet from Paper + Spark (someday we'll combine forces and be Spark + Oats... just kidding 😆). Janet is an accountant and sells tons of different kinds of spreadsheets to help creative business owners track their finances like this. I HIGHLY recommend taking a look at her options here. I also went through Janet's course Next Level Numbers in 2020, and it helped me examine my business metrics and revenue even more to guide my decision making and where to spend my time. Her money mapping exercise alone was a game-changer!

And lastly, it can be easy to get hung up on metrics in your business that really don't matter. This article from Wandering Aimfully is super helpful all about what business metrics to actually pay attention to (hint: it's not that many!).

And that's it! Spreadsheets, Quickbooks, and Mint are my only systems. And taxes? I do my own taxes using TaxAct. Maybe one of these days I'll hire a real accountant for tax time, but I strangely like the challenge. 🤓 I'm pretty nerdy and I like being in the weeds of my business numbers like this, but I know that's not everyone's cup of tea!

P.S. I am certainly no professional accountant or financial advisor, these are just the tools that have worked for me over the years. If you want specific advice on your own business finances, I'd recommend reaching out to a certified accountant, financial advisor, or business coach that specializes in finances.